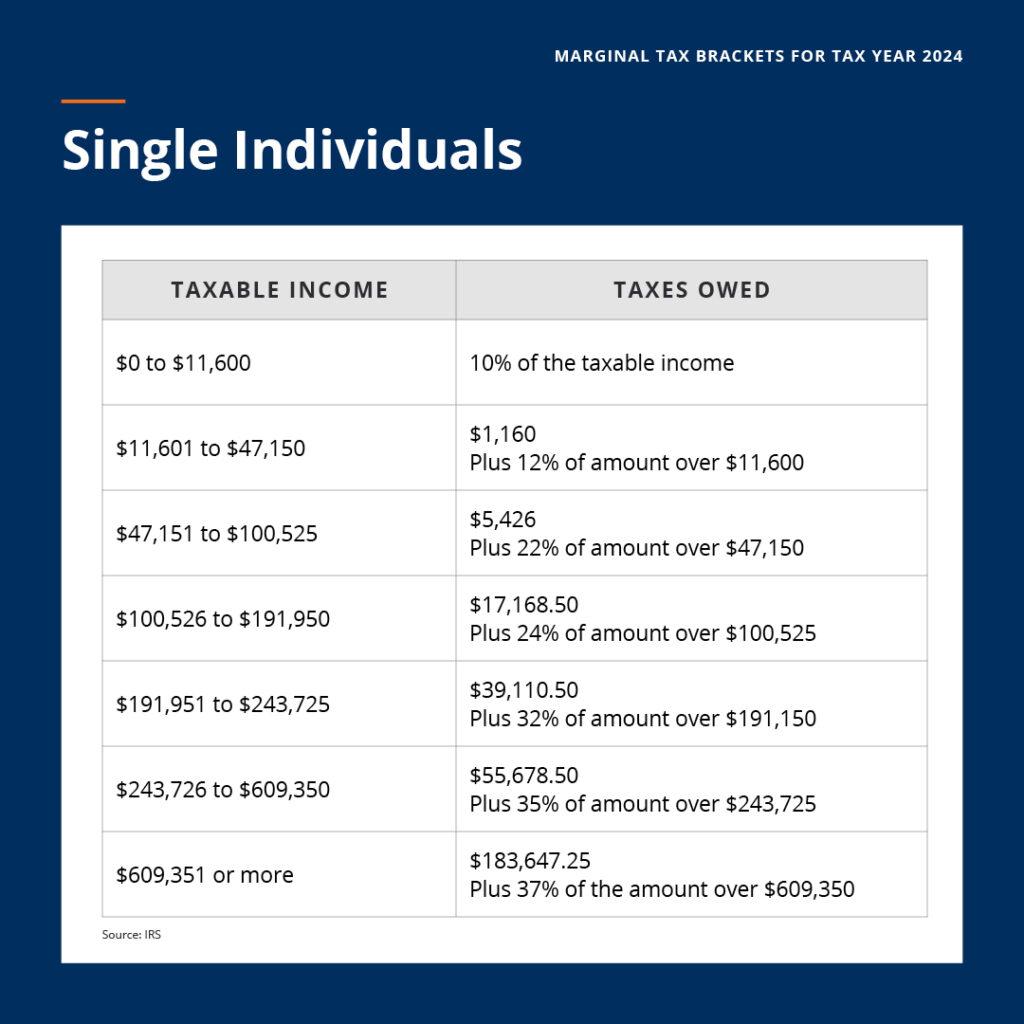

Tax Brackets 2024 Single Over 65. The 2023 tax year—meaning the return you’ll file in 2024—will have the same seven federal income tax brackets as the last few seasons: There will also be changes for.

The internal revenue service adjusts federal income tax brackets annually to account for inflation, and the new brackets can help you estimate your tax obligation. 10%, 12%, 22%, 24%, 32%, 35%, and 37%.

Tax Brackets 2024 Single Over 65 Images References :

Source: francescawhannie.pages.dev

Source: francescawhannie.pages.dev

2024 Tax Brackets Single Over 65 Rica Natalya, Federal income tax rates and brackets.

Source: celebmercedes.pages.dev

Source: celebmercedes.pages.dev

Irs Standard Deduction Seniors Over 65 2024 Dona Fidelity, For the 2023 tax year (for forms you file in 2024), the standard deduction is $13,850 for single filers and married couples filing separately, $27,700 for married.

Source: mallorywsybyl.pages.dev

Source: mallorywsybyl.pages.dev

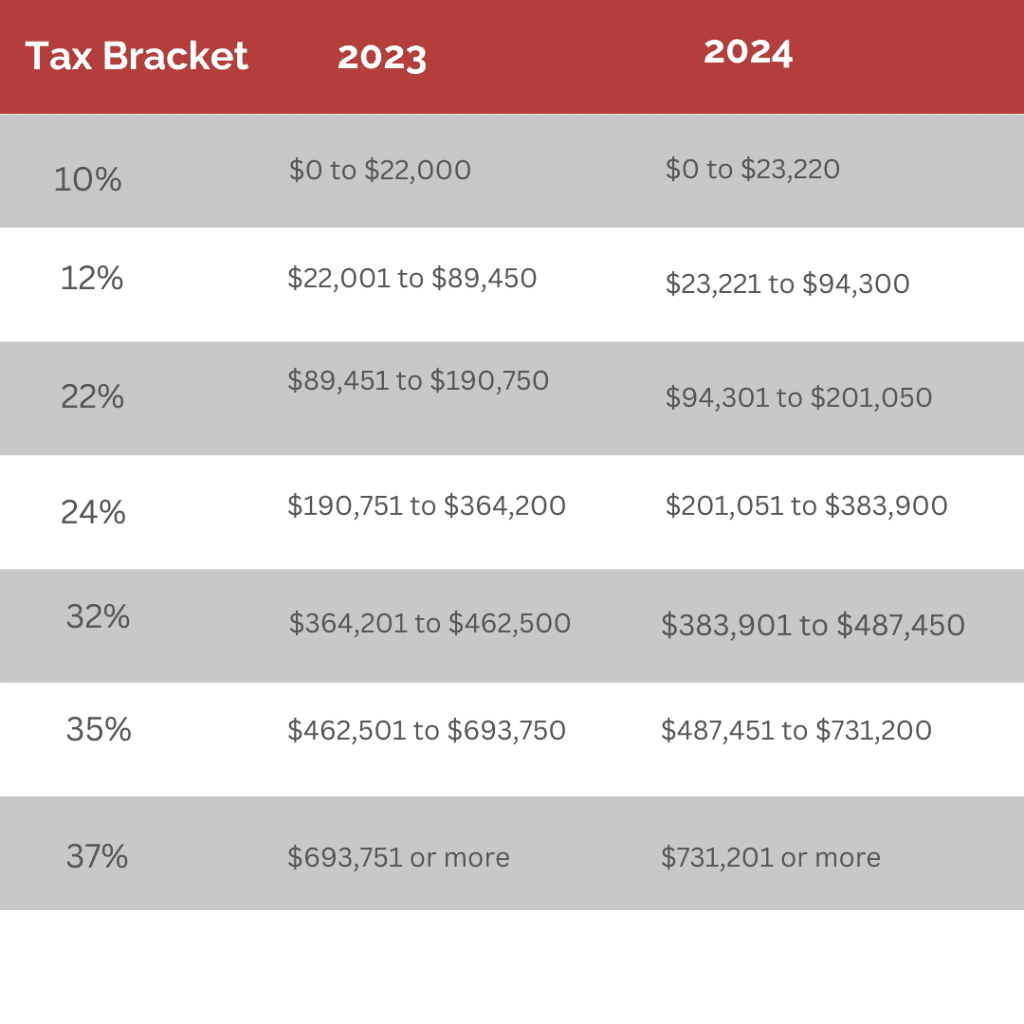

2024 Tax Brackets For Seniors Over 65 Single Lonni Randene, Income thresholds for tax brackets will increase by approximately 5.4% for 2024.

Source: blissqmadelyn.pages.dev

Source: blissqmadelyn.pages.dev

2024 Standard Tax Deduction For Single Rebe Alexine, For the tax year 2024, the top tax rate is 37% for individual single taxpayers with incomes greater than $609,350 ($731,200 for married couples filing jointly).

Source: carleeqhollyanne.pages.dev

Source: carleeqhollyanne.pages.dev

2024 Federal Tax Brackets Married Joint Single Luz Stepha, The highest earners fall into the 37% range,.

Source: www.kiplinger.com

Source: www.kiplinger.com

2023 and 2024 Tax Brackets and Federal Tax Rates Kiplinger, Tax rates report, giving you an early look at what brackets and other key tax figures will look like in 2024.

Source: barriejanifer.pages.dev

Source: barriejanifer.pages.dev

Irs Tax Brackets 2024 Single Over 65 Aurlie Alvinia, This amount increases to $1,950 if they.

Source: electrawroze.pages.dev

Source: electrawroze.pages.dev

Standard Deduction For 2024 Single Over 65 Melli Siouxie, You can use our federal tax brackets calculator to determine how much tax you will pay for the current tax year, or to determine how much tax you have paid in previous tax.

Source: guglielmawberti.pages.dev

Source: guglielmawberti.pages.dev

Tax Brackets 2024 Married Jointly Over 65 Ardith Mozelle, Bloomberg tax has released its annual projected u.s.

Source: lainaarlette.pages.dev

Source: lainaarlette.pages.dev

Tax Withholding Calculator 2024 For Retirees Uk Lotta Rhiamon, The internal revenue service (irs) adjusts tax brackets for inflation each year, and because inflation remains high, it’s possible you could fall into a lower bracket.

Posted in 2024